- A new study finds the benefits of Wegovy for diabetes, heart disease, and weight loss can last up to four years.

- The findings offer new insight into preventing rebound weight gain, a common side effect of stopping GLP-1 drugs for weight loss.

- Other research has shown that coming off GLP-1 drugs slowly can help promote weight management, as can regular physical activity.

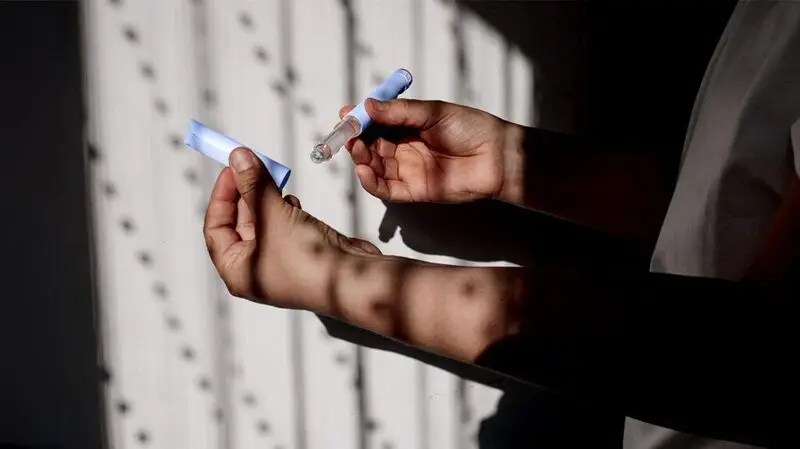

Recently, GLP-1 drugs like Ozempic and Wegovy have become extremely popular for weight loss.

A recent survey finds that 1 in8 people in the United States have taken one of these medications for weight loss, 6 in 10 of whom were people with diabetes or cardiovascular disease. Traditionally, these GLP-1 agonists have been used to treat diabetes and heart disease.

Now, a new study published May 13 in

Only Wegovy has been approved for weight loss by the Food and Drug Administration (FDA), though “off-label” use of GLP-1 medications for weight loss is widespread.

The reported weight loss from GLP-1 drugs can range from 10% to 15% of a person’s original weight.

The new study, known as the SELECT trial, found weight loss to be in the lower end of this range, in part due to variations in its study cohort: People who are more overweight when they begin taking the drugs lose more weight quickly. The study included more than 17,000 adults with overweight or obesity who did not have diabetes.

The findings show an average 4-year weight loss of -10.2% of one’s initial weight, a reduction of 7.7 centimeters in waist circumference, and a reduced waist-to-height ratio of 6.9%, compared to people taking a placebo.

Many users of these drugs experience a slowing in weight loss after about a year, often referred to as an Ozempic or Wegovy plateau.

It has been suggested that once a person stops taking a GLP-1 agonist, weight automatically returns.

However, another recent study presented May 12–15 at the European Congress on Obesity, found that patients taking semaglutide (the active ingredient in some GLP-1 drugs) maintained weight loss by slowly tapering down their dosage.

In addition, a Danish

“When people start taking the semaglutide-type drugs such as Wegovy or Ozempic, the majority of their weight loss occurs within the first year, or the first year and a half,” said Cheng-Han Chen, MD, the Medical Director of the Structural Heart Program at the MemorialCare Heart & Vascular Institute at Saddleback Medical Center in Laguna Hills, CA.

“And then after that, you don’t lose more weight, you just keep it off.” Dr. Chen was not involved in the study.

Mir Ali, MD, bariatric surgeon and medical director of MemorialCare Surgical Weight Loss Center at Orange Coast Medical Center, CA, not involved in the study, told MNT plateaus are common with weight loss.

“The body sort of levels out for a bit when all the calories are equaling the expenditure each day,” Ali said.

“Weight loss itself is not the only measure of an improvement in health. Sometimes what we see is that the scale may not be changing much, but the inches are still coming off. If the patient continues to do the right things, the scale catches up.”

— Mir Ali, MD, bariatric surgeon

Based on several different GLP-1 chemicals, these drugs have slightly different ways of addressing diabetes, heart disease, and weight loss.

The injectable Wegovy and Ozempic and the tablet-based Rybelsus are based on the chemical semaglutide, while other products, such as the injectable Saxenda and Victoza, are liraglutide drugs.

Mounjaro and Zepbound are also injectable and contain tirzepatide, which mimics two intestinal hormones: GLP-1 and glucose-dependent insulinotropic polypeptide (GIP).

Having overweight or obesity are major risk factors for diabetes and cardiovascular disease.

GLP-1 medications also help manage diabetes by increasing production of insulin after a meal. This helps control blood sugar.

“In addition to the effects on weight loss and diabetes control — both cardiovascular risk factors — other mechanisms of action have been proposed for the entire class of GLP-1 agonists,” Jayne Morgan, MD, a cardiologist and the executive director of Health and Community Education at the Piedmont Healthcare Corporation in Atlanta, GA, not involved in the study, told MNT.

Morgan noted that results of a recent trial in which adverse cardiovascular events were decreased by 20% in people taking Ozempic compared to a control group.

“There is a school of thought that these drugs as a class may bind to GLP-1 receptors directly on the heart or arteries, or perhaps bind to some other critical target reducing inflammation or impacting cardiac function in some other positive way.”

— Jayne Morgan, MD, cardiologist

Only Wegovy is approved for weight loss, but other GLP-1 drugs are similarly effective and are approved for diabetes and heart health.

A pharmaceutical company only receives approval for a specific use by conducting studies and supplying supporting evidence. This can cost more than they consider worth spending.

“There’s not a lot of monetary benefit for them from additional indications [uses] if they can’t keep up with production demand as it is,” Ali said. “I think you’ll see [more approvals] as other medications come online.”

Still, the demand for these medications is so high that pharmaceutical companies have had difficulties producing enough of them.

The cost for a patient is not insignificant. The list price of a month’s supply of Wegovy, for example, is $1,349.02, or $16,188.24 per year. Ozempic costs $935.77 each month. Special offers may lower these prices.

Private U.S. health insurance may cover some of this cost, but typically not all of it. Medicare is legally prohibited from paying for weight-loss medications.

Ali cited bariatric surgery as an example. “There’s tons of data supporting how — when a patient has surgery for weight loss in the long run — it saves the insurance companies money because they’re resolving their diabetes and high blood pressure and all of these things,” he said. “And it’s the same with these medications. If the patients get to a healthier weight, they’re no longer diabetic, they don’t need high blood pressure medication,” he noted.

“It’s a slow process, and as long as there’s continued data to show that these medications save costs in the long run, then I think eventually the insurance companies will come around. But it takes a long time.”